Today, on July 2, 2024, the central bank of the Netherlands (DNB) invited 12 journalists to have a look inside its new gold vault at the Dutch army base near Zeist. DNB stores 190 tonnes (one third) of its gold in this vault. The central bank states it invited the journalists to show the gold is there, how it is safeguarded and serves as the asset of last resort ("insurance"). Journalists couldn't bring cameras but video images were provided by DNB. rb.gy/dzyd85

Earlier, in May 2023, DNB said "gold is the ultimate anchor of trust. If the entire financial system collapses, you still have the gold and the gold retains its value." rb.gy/fduoz4

In October 2022, DNB Governor Klaas Knot mentioned, "the balance sheet of the Dutch central banks is solid because we also have gold reserves and the gold revaluation account is more than 20 billion euros," in response to a question about DNB's losses due to unconventional monetary policy. rb.gy/vcxpgx

In April 2019 it read on DNB's website: "Gold is the perfect piggy bank – it's the anchor of trust for the financial system. If the system collapses, the gold stock can serve as a basis to build it up again." Although this statement was removed several years later, it can still be read on the Internet Archive. rb.gy/tekm3i

DNB allowed journalist with their own cameras in its previous vault in Amsterdam in April 2016. rb.gy/g9fbpz This was a little while after DNB had repatriated 120 tonnes from Federal Reserve Bank of New York in November 2014. shorturl.at/Ur1ZI

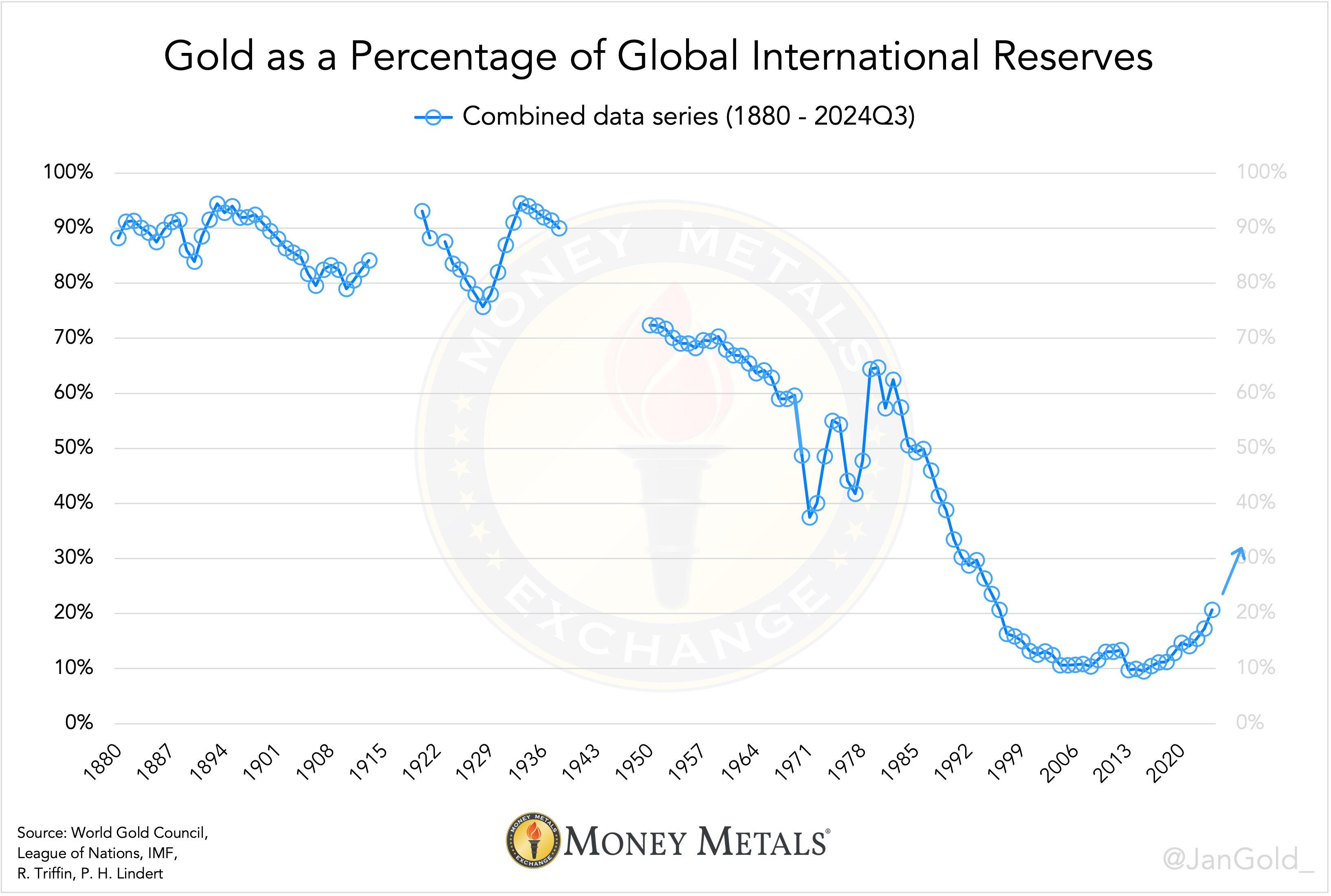

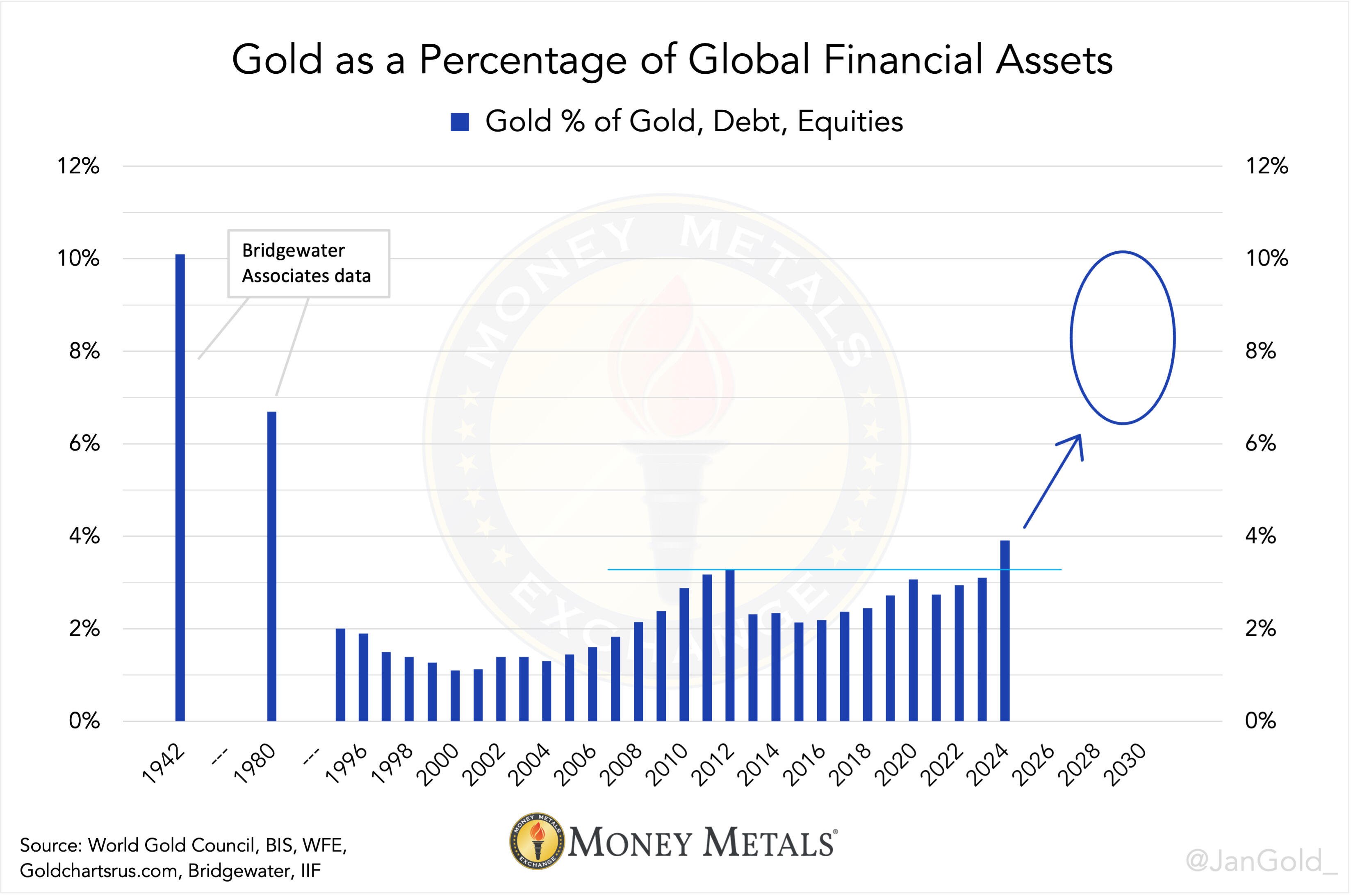

DNB (as well as other European and Asian central banks) is clearly pro gold and prepared for a new gold standard. rb.gy/ex9flx